Built for Results.

Clients achieve

average EBITDA lift

after deployment

Less than

to live insights that

move the needle

Based on

of M&A Transaction

Experience

All delivered through powerful, C-suite-focused Command Centers.

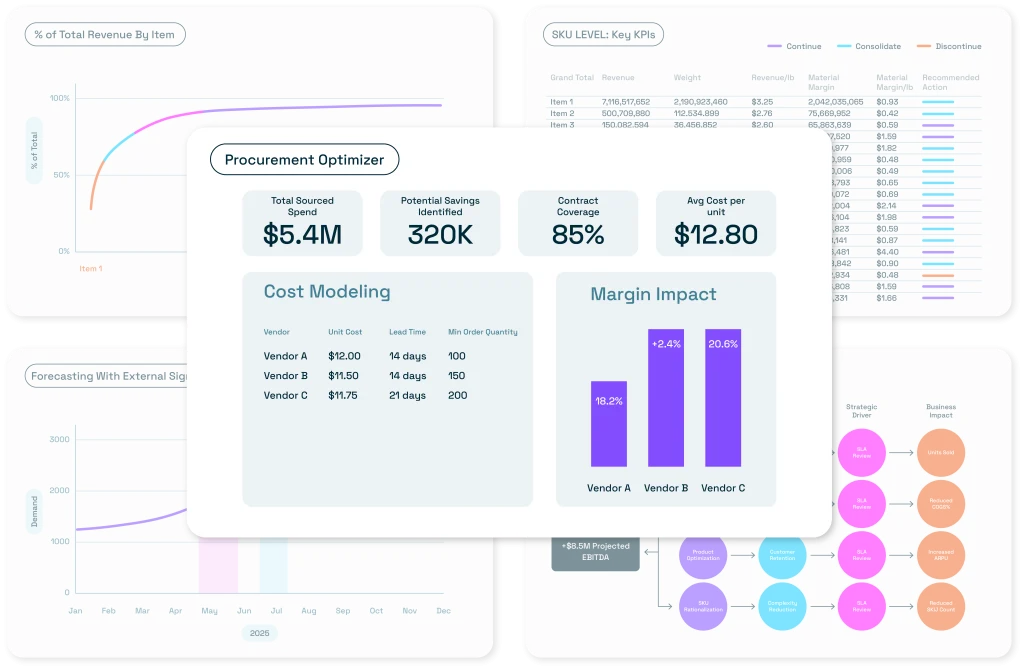

Finance Command Center

Example Capabilities:

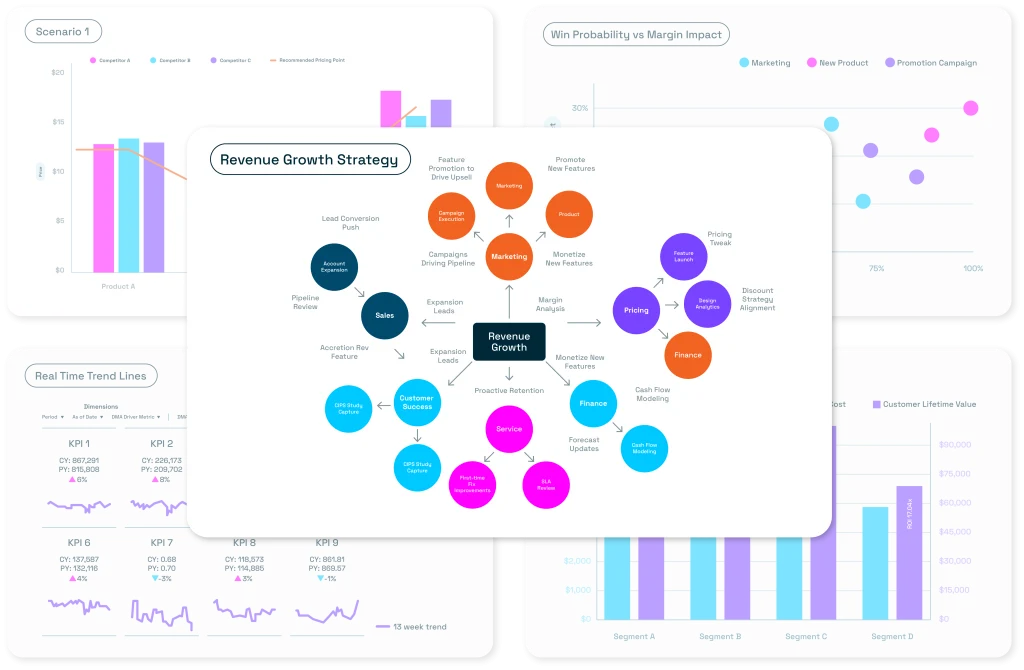

Revenue Command Center

Example Capabilities:

Product Command Center

Example Capabilities:

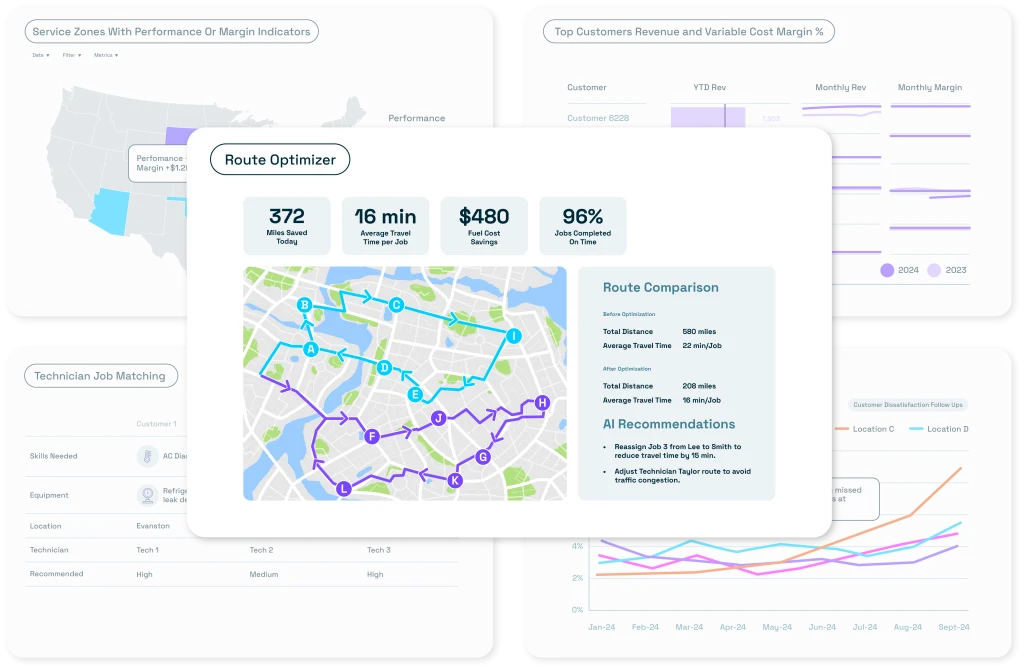

Service Command Center

Example Capabilities:

Featured Integrations

Value Orchestration Insights

Stay ahead of the game with our unique perspectives on driving enterprise value in the AI era.

Intelligently Different from Other Intelligence Systems

Traditional Business Intelligence

& Decision Intelligence

Value Orchestration

with Teragonia

Static Dashboards

Live, Prescriptive Signals

Operator Blind Spots

Cross-Functional Clarity

Requires Change Management

Zero-Disruption Deployment

Data-Rich, Insight-Poor

Action-Oriented, Value-Focused

Teragonia helped us go from data-rich to insight-rich—cutting through the noise and highlighting what truly drives value. Unlike traditional BI, it doesn't just report on the business; it changes how we run it.

Matt Ellis

Executive Vice President & Chief Financial Officer

Teragonia has been our strategic partner in turning unstructured information into real-time intelligence we can act on. They’ve cut complexity out of finance and operations, aligned our board and executives, and spared us the cost, time and high risk of trying to build an in-house data science team.

Anders Farrugia

Teragonia gives us one source of truth, but more importantly, it makes the data actually work for us. Unlike business intelligence that just summarizes performance, Teragonia proactively surfaces issues and action opportunities—in real-time and at the right time.

Andy Kunkler

Chief Financial Officer

As a PE advisor, I’ve seen plenty of analytics solutions. Teragonia stands out because it prioritizes outcomes over output. It’s the rare platform that translates strategy into action with consistency.

Carsten Weber

Senior Private Equity Advisor

Teragonia is our most strategic tech partner. They go beyond business intelligence by helping us take decisive action—not just monitor KPIs. They’ve embedded themselves in how we create value across the business.

Mike Buccheri

Chief Executive Officer

Industry Solutions

Foundational Tech Infrastructure

Our core analytics and AI platform drives informed decision-making with enhanced clarity and focus, and rapidly unlocks enterprise value

Core Features:

Connect All Your Data Sources

Integrate data from multiple source systems effortlessly

Critical for breaking down silos and creating a unified view

One Trusted Data Source

A secure, centralized cloud hub for all your data insights

Foundational for reliable decision-making and enterprise-wide alignment

Interactive Dashboards

Visualize complex data through easy-to-understand dashboards

Empowers leaders with actionable insights

Enriched Data Flow, Fully Automated

Reverse ETL capabilities enriches your data and ensures your data flows exactly where it is needed for function teams to act on

Enables real-time, action-oriented data flow

Additional AI capabilities are actively in development

Scott Briggs

BS International Business | American University of Paris

BS Computer Science | American University of Paris

Seasoned DevOps and infrastructure engineer with expertise in AWS, Kubernetes, and Terraform; led cloud migrations and scalable infrastructure projects at Sfara, FanDuel, and Kickstarter.

With over 15 years of experience in small and medium-sized startups, Scott is a seasoned expert in designing, optimizing, and maintaining robust, scalable, and secure infrastructure. He specializes in automation and embedding security from the ground up, consistently delivering reliable systems tailored to meet dynamic business requirements.

Prior to joining Teragonia, Scott made a significant impact at Sfara, where he built the company’s entire infrastructure from scratch. He engineered systems capable of supporting hundreds of thousands of users with seamless scalability, implemented automated development pipelines, and introduced observability tools to monitor and manage resources effectively. Additionally, Scott led the infrastructure team in achieving ISO27001 security certification, ensuring security was integrated into every aspect of the system and transforming it into a critical asset for business-to-business operations.

Beyond his technical expertise, Scott has a proven track record of managing and mentoring high-performing teams. As a Senior DevOps Engineer at FanDuel, he gained invaluable experience in scaling infrastructure and optimizing resources to support millions of daily users, aligning technological capabilities with organizational goals.

Jack Amedio

Master’s in Human Resources | University of Illinois

Bachelor’s in Management | Loyola University

Former Financial and Operations Manager at Houlihan Lokey, Golin Harris, and MSL Group.

Jack is a highly driven, cross functional professional with extensive experience in operations and administration.

Prior to joining Teragonia, Jack held financial and facilities management roles for Houlihan Lokey, MSL Group/Publicis, and Golin Harris in which managed and created processes and trainings for multiple functional areas ensuring operational and administrative procedures were well planned, efficient, cost-effective, and aligned with business objectives while ensuring initiatives, internal events as well as client events propelled employee and client engagement.

Jack holds undergraduate degrees from University of Illinois and Loyola University Chicago and has completed graduate certificates in Business Administration, Strategic Human Resources, and Operations at Cornell, CUNY-Buffalo, and University of Illinois and is in the process of completing a Master’s in Human Resources at Loyola University Chicago’s Quinlan School of Business.

Mason Taylor

MS Analytics | Georgia Institute of Technology

BS Management Information Systems | Oklahoma State University

Former analytics engineer at Cyderes and ConocoPhillips with a Master’s in Analytics from Georgia Institute of Technology and a Bachelor’s in Management Information Systems from Oklahoma State University

Mason is an Analytics Engineer with deep experience in data analytics, business intelligence, machine learning, and cybersecurity. He brings a proven track record of leading analytics engagements spanning architecture, insights, visualizations, and delivery.

Before joining Teragonia, Mason was a Senior Analytics Engineer at Cybersecurity MSSP CYDERES where he built a scalable, standardized, and secure analytics architecture for over 300 clients across many industries and consulted with them to deliver insights through bespoke data driven solutions. In addition, he managed the data delivery of the insight platform leveraged by the Security Operations Center to respond to incidents in a timely and effective manner.

Prior to joining CYDERES, Mason worked in ConocoPhillips’ Analytics and Innovation Center of Excellence holding varied roles within the Data Analytics organization from Data Engineering, to Business Intelligence, and Data Science. He delivered robust data solutions in all operating units for various functions including Engineering and Production, Finance, IT, and more. Including projects to standardize cost and production data across operating units.

Mason started his career at The Williams Companies in cybersecurity and transitioned to cybersecurity at ConocoPhillips where he found his passion for Data Analytics through SIEM management, detection engineering, and threat intelligence.

Grace Sun

Bachelor’s in Finance & Accounting | Georgetown University

Former analytics engineer at Houlihan Lokey and financial analytics at JP Morgan Chase with a Bachelor’s in Finance & Accounting at Georgetown University

Grace is a seasoned analytics engineer with specialized expertise in crafting and implementing analytics solutions that drive agile, informed executive decisions in M&A and value creation for private equity-backed companies.

Before joining Teragonia, Grace was a part of the data science and business analytics team at Houlihan Lokey. She has excelled in harmonizing, enriching, and analyzing data from diverse sources, providing key insights that enabled private equity investors and portfolio company executives to make rapid, data-driven decisions across the investment lifecycle. She has developed novel analytics solutions, including deal sourcing and evaluation tools for platform investments that employ a buy-and-build or de novo growth strategy, as well as post-close value creation and KPI reporting tools for operators and management teams.

Grace has also worked at JPMorgan Chase & Co. in the Global Finance and Business Management rotational program, where she built analytics solutions to evaluate banker attrition and KPI reporting within the Global Private Bank.